“If council has considered it is a high priority not to increase the real estate tax rate, sending that message early has value.” — City Manager Mark Jinks

In its FY19 budget guidance, adopted Tuesday, Nov. 14, City Council signaled its intention to maintain the real estate tax rate, while acknowledging the austerity that may result.

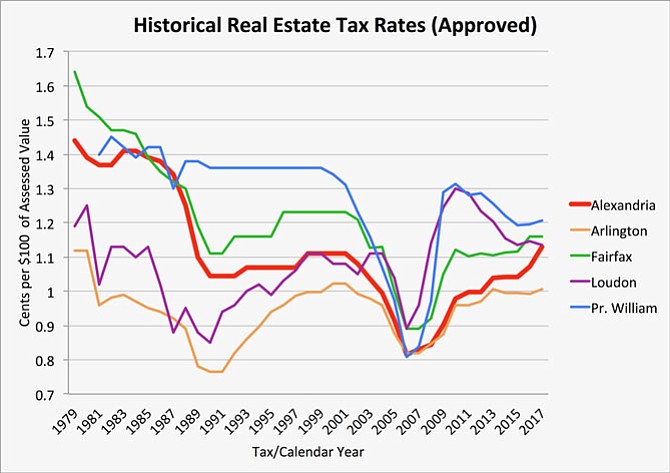

Each fall, council gives the city manager parameters for building the proposed budget, which council then tweaks in the springtime. In recent years, council has typically enabled the manager to introduce changes to the city’s tax-and-fee structure, of which the real estate tax generates some two-thirds of General Fund revenues. Over the past 10 years, council revised the manager’s proposal up 8 times, down once (2013), and once (2015) made no change. For nearly three decades since 1979, the property tax rate fell on average, reaching an all-time low of $0.815 in 2006, according to the FY18 budget document. Since then the rates crept up, reaching $1.13 presently. Though this level hasn’t been surpassed since 1988, neither has the rate crested the 39-year average of $1.115 since 1988. And $1.13 is still low relative to jurisdictions regionally.

After debate Tuesday about leaving flexibility for another increase, council decided unanimously to direct the manager to maintain the current rate of $1.13 when crafting his FY19 proposal. That’s not a promise. Council could opt to raise the rate, and households may pay more with rising assessments in any case. But it’s a relatively uncommon restriction. In the past five budget cycles, council mandated a similar restriction only once, in FY15 (though in the end raised the rate anyway).

City Manager Mark Jinks redirected a couple questions about his opinion of the ramifications back to council. Asked if he feels that not raising the rate is “doable” and if he can “live with” it, he said that he and his staff would build a budget around whatever parameters council gives him.

“It’s just a matter of what’s included and what’s not,” he said. “If council has considered it is a high priority not to increase the real estate tax rate, sending that message early has value. If in fact you want to leave it as — … an open question until you see what the consequences of that [are] — you may not want to include it. It’s really what your preference is. This is your guideline; this is your sending the message to me, to the school board, to the community.”

Though quick to add that they don’t necessarily advocate raising taxes, a few council members expressed discomfort with not leaving the question more open.

Mayor Allison Silberberg said that in the past she’s suggested council not direct, but rather “urge [the manager] to come in without a tax increase,” giving him some “flexibility.”

Councilwoman Redella Pepper cautioned that a budget proposal based on no tax increase “could be so austere that nobody will like it.”

Councilman Paul Smedberg offered a similar caution, saying: “I think we have to go in eyes wide open, knowing that there will be no room for anything, essentially.” He pointed out that the city already anticipates a funding gap — $32 million, according to a forecast presented at council’s retreat Nov. 4. He worries that transportation and public school demands may require dipping into funding for capital projects. But he believes capital commitments should be “sort of sacrosanct … We have got to commit to sticking to our guns … Typically it’s the councils that have been the ones that have moved the projects out, for various reasons. But we’re going to hopefully change that kind of thing.”

Vice Mayor Justin Wilson took the hardest line, saying: “It’s no secret that I think this is the most important part of the budget process, and I always have. Because this is the opportunity to set the framework for the budget. And I have to say” — referring to earlier discussion about council members’ individual meetings — “the council speaks through its legislative action, not through ex parte conversations with the staff. I’m deeply concerned from a process perspective with the suggestion that we say one thing in our resolution and then convey something else in conversations. This is the opportunity for the council to speak. So if we do not want to see the tax rate increase in the proposed budget, then let’s say that, and say that as a council. If we want to give [Jinks] that flexibility to bring in a rate increase, then let’s not say that. But, one way or the other, we need to say that.”

Councilman John Chapman concurred, saying: “There’s an opportunity here for us to allow the manager and the manager’s professional staff to make the cuts necessary. … I don’t know if we make the best cuts when it comes to making cuts, when it’s left directly to council.” That was reflected last cycle in “our decisions — every member up here — to not make any cuts on the operational side last year. Not one person really came with a cut that was worthy.”

“You can always add back during the budget process,” said Wilson. “But if we feel like there is a desire to make additional reductions, I think Councilman Chapman was dead on target: the budget process is not a good time to make those decisions.”

Residents can access council’s FY19 budget process and guidance documents — Resolutions 2796 and 2797 — at alexandria.legistar.com/Legislation.aspx.